Investments and Equities

Dec 18, 2024

Capital investments directly in commercial ventures and investments through capital markets are different models of investments. While one is an organic investment model, the other one is inorganic.

What is investment? It is a process of deploying a person's money into a business or a commercial project for a predetermined profit. An investor is essentially a person, with capital at his disposal, who is interested in generating income from surplus funds. Investment is not a bad concept and it is not new either. Humans have practised this concept since primitive days – perhaps as old as the human species - and believe every development humans have achieved hitherto, is the result of investment. It evolved over a period. Instead of financial assets, investments were in the form of perishable goods, such as dried fruits that could be sold at higher prices or grains that could be stored and later traded for more valuable items.

Over time, the land was considered an asset. In the early days, with a low density of population land was not costly. However, buying land as an asset was considered the first step of investment. Money was not used as a medium of exchange. It was an outcome of resource accumulation. The need to store commodities and goods for a longer time became increasingly challenging, especially since many items were perishable. The need for transactions and safeguarding one’s fortunes for the future led to the introduction of money.

As time passed, the concept of money and investment evolved. We shifted from bartering commodities to using money for exchange. Interestingly, money itself became a commodity unit with the promise of the government to pay the designated value to the money holder. This means even if we do not have a specific use of a certain amount of money, we treat it as a material to generate more wealth. Now, the concept of investment has fundamentally changed. When we invest money to multiply it, every stakeholder and the entire trading system claims a share. This raises the question: where is all this money coming from? There are limited ways to multiply money, and business remains the primary method. Money is earned through commercial trade — buying and selling products or services. We have institutions that lend money and charge interest.

The government promotes Foreign Direct Investment (FDI) and Foreign Portfolio Investments by institutional investors. Institutional investors never put money into building a factory but in buying stakes directly from the promoters or buying equities from the secondary market. They are interested in a promoter’s enterprising skills and buy them out at the best price they can negotiate. This is not an organic investment process, but an inorganic portfolio building. Institutional investors are not entrepreneurs. That means all the investors are not entrepreneurs.

When market sentiment shifts, foreign investors withdraw their money and channel the wealth into economies where they believe there will be better returns. The recent fluctuations in the Indian market can be attributed to China, which has invited more FDI by creating a favourable investment climate. In this context, the absence of long-term investment raises concerns about how businesses can thrive.

The government’s Make in India is a better investment opportunity for entrepreneurs from an economic perspective. Make-in-India was first for entrepreneurs and later for portfolio investors, who would buy stakes in the make-in-India ventures when the ventures were ready to make a profit.

While short-term investment is considered mostly as a trading, medium-term investment in stocks can be detrimental to the economy. When investors frequently withdraw their money, it destabilises the market. This practice poses a significant risk to ordinary investors because of the erratic movement and wild fluctuation. Some market operators focus on intraday trading to take home the margin of fluctuation. Though foreign investors do not focus on intra-day trading, operators take the chance of large-scale foreign institutional buying as they are sure of a price rise at the time of their active buying. At the same time, Foreign Institutional Investors (FIIs) show interest in highly liquid stocks.

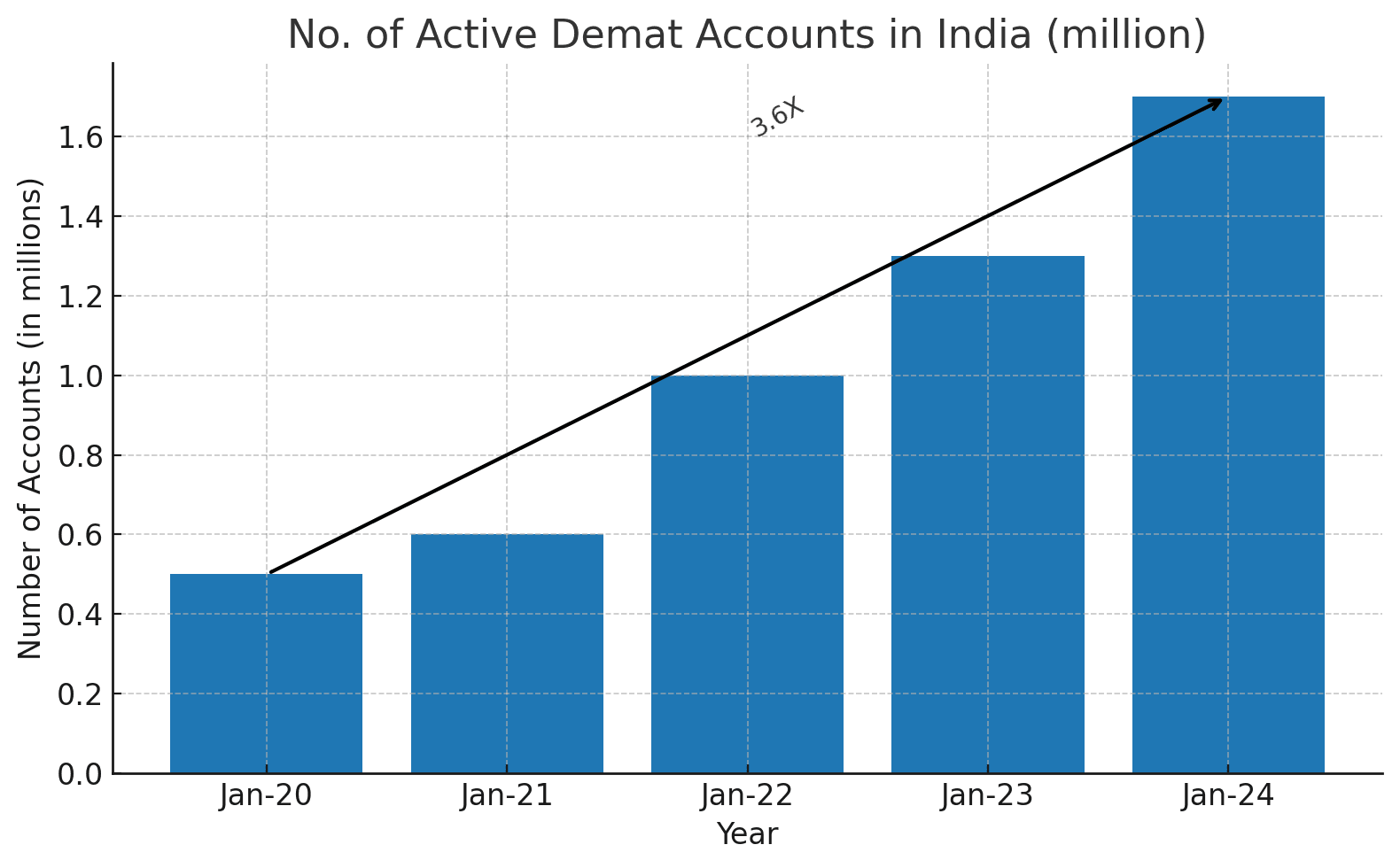

While equity investment appears to be an attractive opportunity to make quick profits, it entails high risk. Many young people, as they learn about the market, are inclined to engage in intraday trading with the hope of quickly making money without parking their money in any stock for the short or long term. Ultimately, it is the large foreign investors, influential domestic players, brokers, and other intermediaries who benefit the most from this situation. Many people involved in intraday trading and lost significantly haven’t learned any lesson. They lost their borrowed money. Such losses aggregate Rs 3.5 trillion. They might have borrowed such money from their employers, unsecured personal loans, friends and family all in pursuit of trading profits. During one conversation, an investor said that despite numerous setbacks, the enticing figures displayed on the trading terminals lured him with hopes of overcoming his total debt. He believed he would recover from all the losses in no time. But losses kept piling up. It is difficult to educate such crazy minds.

It is difficult to prevent such people from becoming the casualty of speculation. SEBI's intervention in these matters is promising as it aims to curb speculation in the riskier futures and options (F&O) segment. The less frequency of contract expiries per week, compulsion on the part of the brokers to collect the margin upfront from the traders, higher margin requirements, the elimination of calendar spread for contracts, strict intraday position monitoring system, etc may curb the risk of the market. Nevertheless, in the long run, other risks will emerge as traders may find new ways to overcome their hurdles.

SAJIKUMAR

Share

Comments